How Do I Buy Aviation Real Estate? An Introduction to the Basics of Smart Aviation Property Investing

A Unique Subset of Property Investment

Today, aviation-focused real estate offers unique investment opportunities for airplane enthusiasts, pilots, investors, and many others. From establishing private hangar space for high-value aircraft to seeking profitable commercial opportunities near and around airports, navigating this highly specialized niche market requires careful planning, consideration, and aviation-specific knowledge. This worldwide buyer’s guide for beginners of sorts offers insights and useful, actionable tips for prospective investors and buyers venturing into the world of aviation-specific real estate investing.

Aviation Real Estate – The Fundamentals

Aviation real estate includes a diverse range of properties, including aircraft hangars, airparks or fly-in homes, private airstrips, and even aviation-related businesses such as FBOs or fixed-based operators. These properties are frequently found near large commercial airports, aviation facilities, or private airstrips, all catering to individuals and businesses with a range of aviation-related needs.

Key Factors that Make Up the Decision-Making Process

Location

General proximity to airports or aviation services is crucial when searching for aviation real estate. Consider factors such as easy and convenient runway access, airspace usage, regulations, and nearby business support-related amenities.

Zoning and Aviation Regulations

Ensure that the property under consideration follows local zoning laws and aviation regulations. For example, there may be restrictions on building or hangar size and heights and aircraft noise levels, while overall land use can impact the suitability of a particular property.

Key Infrastructure Concerns

Assess all existing infrastructure, including runway alignment, composition, condition, taxiway access, and services like fueling availability. Upgrading or maintaining these facilities may incur sizable additional costs. Infrastructure impact is a key metric when evaluating aviation-type real estate of any kind.

Community and Amenities

Evaluate the surrounding aviation support community. Look for amenities such as general aviation and jet fuel services, aviation maintenance and repair facilities, and public and private transportation options. Ease of accessibility and convenience is vital for both private and commercial planned use going forward.

Future Development

Research any anticipated or planned future developments in the area, such as airport expansion projects or changes in airspace use, such as aircraft traffic departure and arrival patterns. These factors can fundamentally impact and negatively alter property value and long-term ROI or return on investment. Proposed noise legislation may also affect airport usage and, ultimately, an investment’s profitability. If there are any questions in this regard, order a full feasibility study.

Types of Aviation Real Estate

Hangars: Hangars provide safe, secure storage and maintenance facilities for aircraft. When searching for a hangar, consider factors such as structure composition and size, door clearance, and security features. The availability of emergency services should also be factored into the decision-making process.

Airpark Homes: Fly-in communities offer custom residential properties with easy-access private airstrip colocation. These airpark properties typically appeal to retired and active pilots and aviation enthusiasts seeking a lifestyle centered around the conveniences of private aviation.

Airstrips, Airports, and Airfields: Ever imagine owning your own airport? Purchasing an airstrip or airfield allows exclusive access for personal or commercial use. When sizing up such properties, evaluate runway length, overall field condition, and navigational aids. With proper planning, the ROI on this kind of investment can be impressive, whether purchasing an existing airfield or developing raw land into a small airport.

Aviation-Related Businesses: Opportunities exist for investing in aviation-related businesses such as FBOs (Fixed Base Operators), flight training schools, and aircraft maintenance and repair facilities. Before making this innovative investment, conduct in-depth due diligence on prior financial performance, clientele, and market dynamics.

Navigating the Complexities of the Investing Process – How to Proceed

Enlist the services of Professionals: Seek guidance from seasoned aviation real estate agents, aviation consulting agencies, and aviation legal experts focusing on aviation real estate transactions. Their specialized skills and knowledge can streamline and fast-track the investing process and mitigate any unforeseen financial risks. Expenditure on professional services is always money well spent.

Exercise Detailed Due Diligence: Perform comprehensive deep-dive due diligence on any property of interest, including title searches, environmental assessments, and financial analysis. It’s best to identify any potential issues or liabilities that may affect the transaction at the earliest stages.

Negotiate Favorable Terms: Negotiate terms that benefit the buyer and are always aligned with your investment objectives and total risk tolerance. Consider variables such as listed and agreed purchase price, financing options, and any contingency clauses that best protect your investment.

Secure the best Financing: Explore all financing options tailored to aviation-specific real estate deals, such as aircraft loans, commercial mortgages, or SBA (Small Business Administration) loans. Work with lenders who understand the unique challenges of financing aviation properties.

Complete the Deal: Once all terms are satisfactory and all conditions have been met, finalize the transaction through the closing process facilitated by legal and financial experts. Ensure that all legal documents are properly and fully executed and ownership rights are successfully transferred securely and legally.

The Final Analysis

Buying aviation real estate requires careful planning and considering location, regulations, infrastructure, and any anticipated future development. Whether you are a pilot looking for a private hangar or an investor seeking commercial buying opportunities, understanding the nuances of this specialized niche market is critical to making the most informed decision possible. The basic guidance outlined in this beginner’s aviation investment guide will help you better navigate the complexities of aviation real estate investing and unlock its potential as a lucrative long-term profit opportunity.

About APN

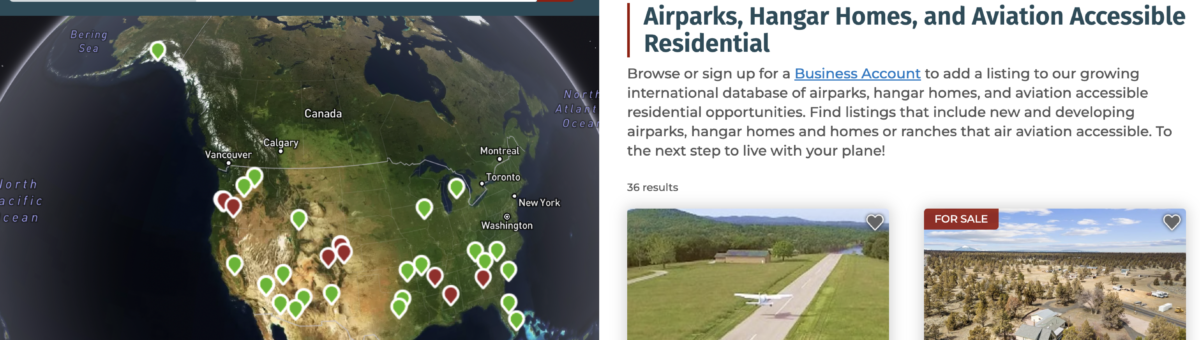

Finding your next aviation property is effortless and convenient with help from APN (Aviation Property Network). The company has on staff a team of seasoned and dedicated aviation real estate professionals who are always standing by and ready to take your call. An aviation property financial investment is a big decision, so it is crucial to work with people who understand the industry.

With APN, you can list a property for sale, lease an aviation property, or rent overnight. Expert guidance and support are always close at hand with the friendly staff of Aviation Property Network. The main website features a growing international database of aviation-related real estate opportunities. From raw land to airport businesses and actual airport purchases, APN has all aspects of aviation property investments under review and under one roof.

Are you looking to buy or sell a hangar, move to an airpark community, buy or sell an FBO, or perhaps even develop a new project? Contact the leader in worldwide aviation property transactions today! Contact APN NOW!

Declaimer: APN is not a financial advisor and makes no claims as such. All information provided here is intended to be educational in nature and is presented for illustrative purposes only. Contact a licensed financial expert or registered accountant if you have specific financial questions.