Aircraft Hangar Sales and Construction in the United States – A Statistical Tariff Analysis

What Can Be Done to Keep Up with Demand?

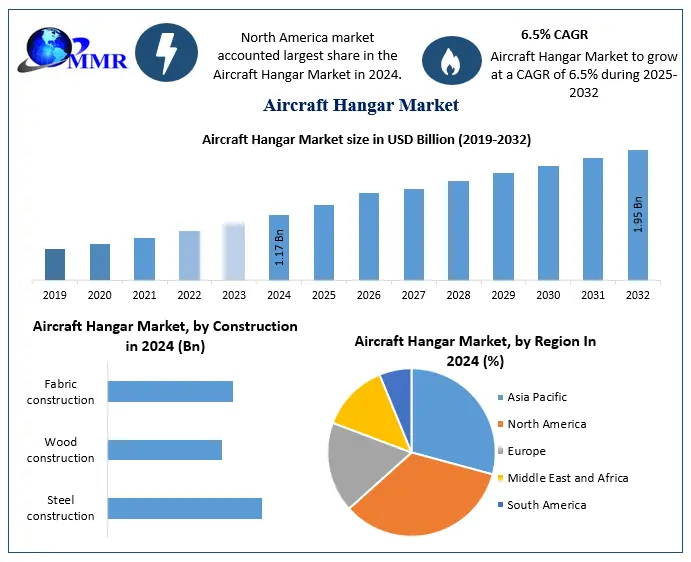

Current Market Overview

The U.S. aircraft hangar market is a significant segment of a much larger aviation infrastructure industry. In 2024, this growing market was valued at nearly $1.7 billion, with projections targeting growth potential up to $8.3 billion by 2030, reflecting a compounded annual growth rate (CAGR) of almost 4.0%. This expansion is driven by several key factors, including the rapidly increasing demand for aircraft maintenance, repair, and overhaul (MRO) services, the growth of private sector and business aviation, and the modernization of airports and their facilities.

Construction Forecast for The Coming Decade

Over the next ten years, the construction of new aircraft hangars is expected to grow exponentially. This trend is mostly influenced by increasing commercial and military aviation fleets, in turn demanding additional storage and maintenance facilities. Moreover, advancements in hangar building and design, such as the integration of smart technologies and sustainable materials, are fueling the appeal of new construction. Yet, the pace of development may be tempered by challenges such as regulatory approvals, funding constraints, and the time-intensive reality of major airport infrastructure type projects.

Importance Of Aircraft Hangars

Aircraft hangars play a critical and essential role in today’s aviation industry. They provide secure shelter and protection for aircraft, insulating valuable assets from harsh weather conditions and potential damage. Additionally, hangars serve as centers for MRO activities, ensuring that aircraft remain in the best condition possible while meeting safety requirements. The functionality and capabilities of hangar spaces directly impacts the efficiency of airline operations, military aviation readiness, and the overall safety of modern air travel.

Impact Of Tariffs on Hangar Construction

Recent tariffs on materials, including steel and aluminum, have added complexities to the hangar construction equation. These newly imposed tariffs have led to increased costs for building materials, thereby complicating the overall expenditure necessary for new construction and renovations. As a result, developers are facing budgetary constraints, causing delays and the scaling down of planned projects. Increasing costs also impact the pricing of hangar services, which are frequently passed on to end-users, including airlines and private aircraft operators.

Addressing These Issues

Yet, the U.S. aircraft hangar market is still positioned for considerable growth, driven by an expanding aviation sector and the necessity for improved infrastructure. While the outlook remains good, those in the industry must navigate obstacles such as high material costs and regulatory hurdles to maintain the pace of efficient hangar facilities development. Addressing these concerns will be key to supporting the ever-changing needs of the aviation industry while maintaining safety and reliability.

More On Tariffs

As mentioned, the recently imposed tariffs on construction materials used in aviation construction projects like steel, aluminum, and lumber have significantly impacted U.S. construction companies, leading to greater costs, project delays, and financial burdens, particularly for small and mid-sized building companies.

Rising Material Costs

Tariffs have caused hefty price increases for key construction materials. For example, steel mill products rose by 2.7% in February 2025, while aluminum mill shapes increased by 1.0%. Additionally, lumber and plywood prices climbed by 1.7%, and copper and brass mill shapes experienced a 1.8% rise. These price hikes are exacerbated by tariffs on imports from countries like China and Canada, which supply a big portion of U.S. building materials.

Impact On Project Costs and Timelines

The increased material costs have resulted in higher overall project expenses. For example, an average 494,000-square-foot facility could easily see an estimated $17.4 million increase in construction costs due to tariffs on steel and aluminum. This cost escalation has made some projects financially impossible and has led to delays as companies acclimate to the latest tariff driven cost structures.

Challenges For Small and Mid-Sized Firms

Smaller construction companies, which typically lack the financial muscle of larger corporations, are particularly vulnerable to tariff related cost increases. Many are simply unable to foot the higher costs, passing them onto clients, leading to lower profit margins and, in some instances, project cancellations. The uncertainty surrounding future tariffs also complicates financial planning for many businesses.

Contractual Adjustments and Risk Management

As an answer to tariff-induced cost increases, contractors are adding escalation clauses into contracts to offset financial risk. However, some project owners are not open to accepting these clauses, fearing budget overruns. These concerns have led to the implementation of new strategies, such as risk-sharing agreements and dividing large projects into smaller phases to distribute financial exposure.

Significant Challenges

The recent tariffs have introduced significant challenges for U.S. construction companies, particularly again, smaller firms. While the goal of the tariffs is to reignite domestic manufacturing, the immediate results are increased costs and operational uncertainties. To navigate these challenges, construction businesses are introducing flexible contract terms while seeking alternative materials and supply channels. That said, tariff response solutions for the construction industry are instrumental in mitigating the long-term impacts of changing trade actions.

Building Hangars Despite Tariffs: Strategies and Alternatives

Considering the ballooning costs sparked by tariffs on imported core materials like steel, aluminum, and lumber, construction companies across America are finding innovative ways to stay relevant and competitive. As the tariffs add new financial hurdles, they also spawn innovation, improved procurement techniques, and better domestic supply chains.

Strategic Sourcing and Supplier Diversification

To reduce the need for tariff-affected imported materials, companies are diversifying their supplier base. This includes sourcing building materials from countries not subject to tariffs, as well as negotiating better terms with local suppliers. Building solid relationships with domestic manufacturers reduces transportation expenses and improves overall supply chain reliability.

Alternative Materials

Many construction outfits are now exploring these alternative materials to balance the cost of traditional ones. As an example, using engineered wood, recycled materials, or composite structures can be excellent cost-saving substitutes for steel and aluminum in various applications. Advances in more sustainable building practices present opportunities to use eco-friendly materials that are typically less impacted by international tariffs.

Prefabrication and Modular Construction

Prefabricated and modular style construction systems allow contractors to manage costs by reducing waste and labor expenses. Components are then made in more cost-efficient ways, ultimately assembled on-site, accelerating project timelines while reducing reliance on costly materials.

Smarter Contracting

To better manage unpredictable pricing, construction business owners can include escalation clauses in contracts that include adjustments that hinge on market uncertainties. Open communication with clients regarding price volatility also helps manage expectations and build trust.

Government Incentives and Grants

Finally, some construction businesses are taking advantage of state and federal incentives aimed at infrastructure development or sustainable practices. These programs create financial relief and offset the increased costs associated with tariff-affected building materials. By adapting procurement strategies, embracing innovation, and advocating for policy support, construction companies can continue building aircraft hangars more affordably, even with challenging rising costs. There is also the expectation that at some point, the tariffs will ease with materials becoming once again more affordable.

About Aviation Property Network (APN)

Finding your next aviation property is fast and convenient with help from APN (Aviation Property Network). The company is comprised of a team of seasoned and dedicated aviation real estate professionals that are ready to help you achieve your goals. An aviation property investment is a big decision, and that is why it is essential to work with those who truly understand the industry.

With APN, you can list a property for sale, lease an aviation property, or rent overnight. Expert guidance and support are always the standard with the friendly staff of Aviation Property Network. The main website features a growing international database of aviation related real estate opportunities. From raw land development to airport businesses and actual airport purchases, APN has all aviation property investments constantly under review and all under one roof.

Looking to buy or sell a hangar, move to an airpark community, buy or sell an FBO, or perhaps even develop a new project? Contact the leader in world-wide aviation property transactions today! Reach out to APN NOW!